Today there are about 78,700 Certified Financial Planners (CFP). In the CFP, world, about 77% are men and 23% are women (1). The career “financial planner” as an emerging career path is relatively young. Several professional organizations have been formed to organize, support and regulate the industry.

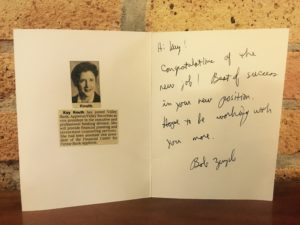

Starting in this male dominated arena, Kay was on the front lines of serving clients who needed complex advice and strategies to facilitate their investment planning. In her first job as a CFP, there was one computer in the entire office (for 10 advisors) to run illustrations and obtain quotes. Creating a financial plan required hand writing out all plan elements and facts on paper, sending it to the home office for review and processing. The finished plan came back 10 days later! If there was a mistake or something needed to be changed, it would have to be completely re-done and the process would have to be repeated.

Kay was adept at completely understanding the client’s wants and needs and creating a plan in order for this to happen for them. She realized that building a solid rapport with prospects and clients was foundational in establishing strong, lasting relationships. An early lesson was that “listening to the client” was more important than “talking”! She fully enjoyed being integral in outlining a more in-depth plan to compliment her client’s lives with a comprehensive approach for the short term as well as the long term. Learning that you build a business and a reputation, one client at a time. And, the most important lesson was to educate and inform clients long before you begin to implement a plan. These life lessons have proven to be career standards for her.

(1) https://www.cfp.net/news-events/research-facts-figures/cfp-professional-demographics